STR, Tourism Economics, report downgrades U.S. hotel forecast citing costs and uneven demand while group travel stays strong

The U.S. hotel industry is dialing back its growth expectations for 2024 and 2025, according to STR, a data benchmarking firm for the global hospitality industry and Tourism Economics, an analytic firm that focuses on the intersection of the economy and travel sector. The downward revision, unveiled at the NYU International Hospitality Industry Investment Conference, reflects a weaker-than-anticipated start to the year and growing concerns about consumer spending.

The U.S. hotel industry is facing a less rosy outlook as hotel operators are facing a squeeze on both sides. Rising labor costs are putting pressure on profit margins, while inflation is dampening demand, particularly for budget-conscious travelers. STR data shows a “bifurcation” in hotel performance, with luxury properties maintaining healthy demand but lower-tier hotels experiencing a pullback.

“The increased cost of living is impacting travel patterns,” said Amanda Hite, president of STR. “While overall travel remains a priority, value is becoming a bigger factor for many Americans.”

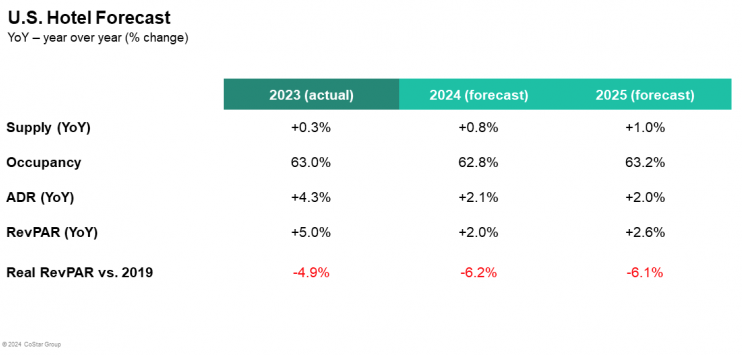

The revised forecast sees lower growth in average daily rates (ADR) and revenue per available room (RevPAR) for 2024 compared to earlier projections. Occupancy is also expected to decline slightly this year, reversing a previous forecast for modest growth.

Looking ahead to 2025, the forecast remains cautiously optimistic. Occupancy is still projected to rise, but ADR and RevPAR are expected to see further downward adjustments. Aran Ryan, director of industry studies at Tourism Economics, sees a potential rebound in travel fueled by a gradual economic recovery and the return of group business and international travel. “Still-elevated interest rates and easing wage growth have contributed to cautious business investment and pinched spending by many middle- and lower-income consumers,” said Aran Ryan, director of industry studies at Tourism Economics, “Looking beyond this near-term pull-back in demand at lower-tier properties, we expect moderate travel growth to resume, supported by a tempered economic expansion and the continued rebound of group, business, and international travel.”

However, rising labor costs pose a significant challenge. STR forecasts labor expenses to eat up nearly 33% of hotel revenue in 2024, putting pressure on profitability. Upper midscale chains are expected to fare best due to their lower labor costs, mirroring pre-pandemic trends. “Higher operating expenses have led us to forecast lower GOP margins,” said Hite. “Labor costs are projected to be nearly 33% of total revenues through the remainer of 2024 and will have the greatest impact on GOP margins. Upper Midscale chains are expected to maintain the lowest labor costs, and thus the most competitive GOP margins for most of 2024, which follows pre-pandemic trends.”

The revised forecast underscores the headwinds facing the U.S. hotel industry in the near term. While travel remains a priority, inflation and rising costs are forcing hotels to adjust their strategies to navigate the current economic climate.

Any thoughts, opinions, or news? Please share them with me at vince@meetingsevents.com.