But most respondents feel it will be a sellers market and the buyer/seller relationship will be challenging.

The newly released 2023 Incentive Travel Index (ITI) reports that, overall, the incentive travel industry is strong. Growth is projected through 2025 for both number of people participating in incentive trips as well as per-person spend. That said, tangible financial ROI and concerns around cost are indexing higher than previous studies, highlighting a underlying caution that stems from an uncertain geo-political, economic, and environmental backdrop. While industry-wide trends emerged, the study reflects variation by geography as well as by industry sector.

The Incentive Travel Index is a joint initiative of the Incentive Research Foundation (IRF) and the Foundation of the Society for Incentive Travel Excellence (SITE Foundation) and is undertaken in partnership with Oxford Economics.

Professionals planning incentive programs in the manufacturing sector were most bullish about a strong 2024 with 70% stating that they expect spending on incentive travel to be above the levels in 2022. This is much higher than 2023 when 40% felt that way. Overall, most sectors, (automotive, finance and insurance, pharmaceuticals and healthcare and technology) reported increases the sentiment that 2024 will exceed 2022 levels, though none approached the 70% range.

“The 2023 Incentive Travel Index drills down to examine the data by industry and geographic location, enabling incentive industry professionals to target the data they need to make decisions to meet their specific goals,” said SITE CEO, Annette Gregg. “The ITI clearly demonstrates that one size does not fit all. Incentive industry professionals need to be nuanced in their approach to client needs and mindful of the fact that there can be significant differences based on industry vertical or geographic location.”

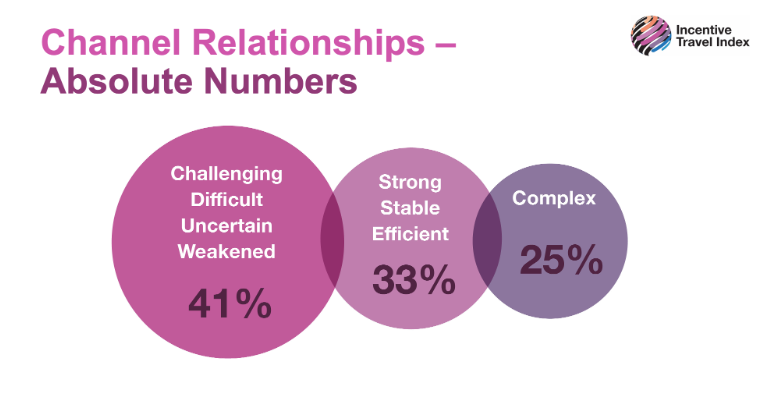

A new area of study reintroduced into the Index this year involved looking at how incentive professionals view current buyer/supplier relationships. Perhaps alarming to some was a finding that 41% of respondents classify these relationships as “challenging,” “difficult,” “uncertain,” or “weakened.”

Not surprisingly, as with the rest of society, political considerations headed the list of things that respondents felt would impact the future of incentives with 51% stating it would be a factor moving forward. Ironically, almost as many responded (24%) disagreed as agreed (31%) that artificial intelligence will significantly disrupt the incentive industry.

“Incentive travel is expected to be fresh and exciting, with 71% of our respondents indicating an increased demand for new destinations not used before,” said Stephanie Harris, IRF President. “With projected growth and increased demand, incentive professionals will also have to contend with challenges of availability, lift, and access to local resources. The supply chain for incentive travel experiences can be complex, so it’s critical to form strong partnerships with suppliers, including hotels, DMOs, and DMCs.”

For additional key findings from the 2023 Incentive Travel Index study as well as reports from previous years, visit https://www.incentiveindex.com/.

Any thoughts, opinions, or news? Please share them with me at vince@meetingsevents.com.