New Study Also Finds Service Level Gap Still Exists

According to a recent Incentive Research Foundation (IRF) survey, the outlook for incentive travel remains strong, with most respondents expecting incentive travel to increase or hold steady through 2024. The IRF’s new study, Incentive Travel Programs – Expectations & Challenges examines how ready the industry is to meet this demand for incentive travel given challenges posed by the broader market. The study explores the ongoing effects of inflation and a tight labor market on the design, execution, and cost of incentive travel programs.

Following up on the 2022 study, Incentive Travel Programs – Expectations & Challenges provides a view of the hospitality market from the perspective of incentive program owners, hoteliers, and tourism bureaus/DMCs. It also identifies discrepancies between levels of service and the expectations of incentive program owners and participants.

“When we fielded the prior edition of this study in 2022, the industry was easing out of the pandemic and the collective ethos was ‘we’re in it together,’” said Stephanie Harris, IRF President. “In 2023, expectations are high, and planners are watching to see if destinations and hotels are truly ready to deliver pre-pandemic service levels. While there is year-over-year improvement, all segments of the industry are dealing to varying extents with staffing shortages, service levels, and cost increases.”

The study was conducted from late April through June 2023. A total of 372 respondents completed the survey, representing four stakeholder groups, incentive planners / third party agency, hoteliers, tourism bureaus / convention & visitors bureaus (CVBs), and destination management companies (DMCs).

Top Planner Concerns:

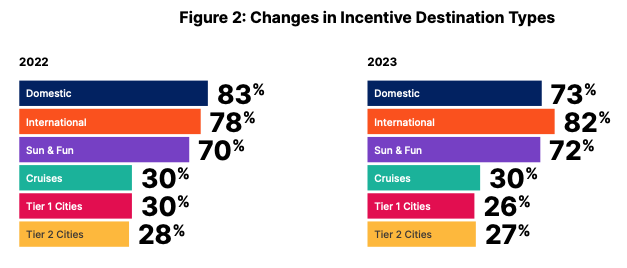

- Incentive travel planners expressed growing interest in international travel – a 4% increase over 2022

- 96% of incentive travel planners indicated that staffing and service levels are a top concern in destination selection

- 88% planners indicated that competitive rates and prices remain worse than pre-pandemic rates, and 80% indicate that hotel responsiveness is worse than 2019 levels

- When partnering with tourism bureaus, CVBs, and DMCs, the top concerns of planners are expense increases (85%), staffing (79%), and transportation (45%)

- Planners noted the areas that have recovered or surpassed 2019 programs are activities and recreation, quality of food, event and activity options, and responsiveness from tourism bureaus and CVBs

Hoteliers and DMCs Opinions:

- 91% of hoteliers indicated all of their food and beverage services are now open with operating hours comparable to 2019 (inclusive of room service)

- DMCs indicate that transportation and staff are the primary drivers of cost increases.

Top concerns of tourism bureaus and CVBs:

- The lack of qualified candidates, elevated wage expectations, and the resources required to get new hires to a level of proficiency combine to create a considerable challenge for tourism bureaus, CVBs, and DMCs

- Daily housekeeping is no longer an automatic expectation – only 72% of hoteliers currently provide housekeeping daily

To download the full study and white paper, visit the Incentive Travel Programs – Expectations & Challenges webpage.

Any thoughts, opinions, or news? Please share them with me at vince@meetingsevents.com.