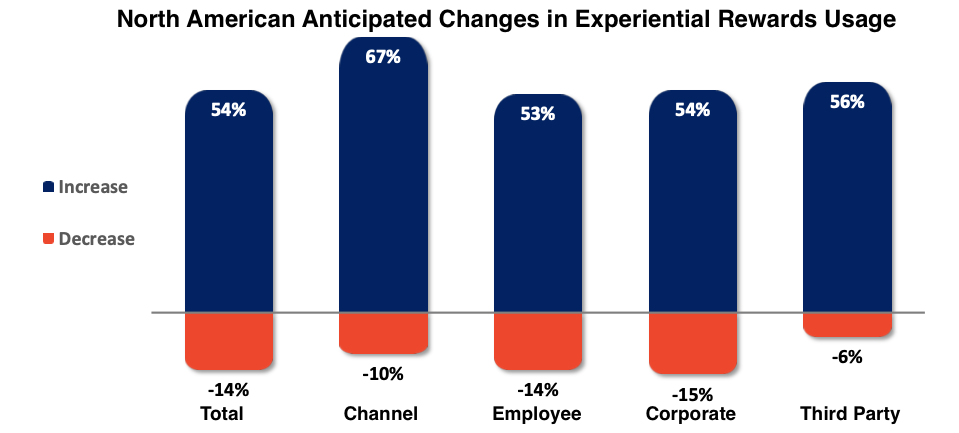

The outlook for non-cash rewards in 2025 remains positive across both North America and Europe

Each year, the Incentive Research Foundation (IRF) commissions a comprehensive study to evaluate the state of the incentive rewards industry. According to this year’s study the non-cash rewards industry is showing signs of robust health, with companies on both sides of the Atlantic anticipating growth and innovation. But while optimism abounds, distinct regional trends are emerging in North America and Europe, particularly in spending patterns and reward preferences.

Economic Optimism Fuels Growth

After a year of cautious spending, businesses are feeling more confident. North American economic optimism has rebounded to 23%, a significant jump from recent lows. Europe is even more bullish, with optimism soaring to 56% from 29% last year. This confidence is translating into increased budgets for non-cash rewards programs, with companies seeking to engage employees through diverse and personalized offerings.

Gift Cards Remain King, But Experiential Rewards Are on the Rise

Gift cards continue to dominate the rewards landscape, accounting for at least 43% of incentives in North America and 41% in Europe. However, experiential rewards are gaining significant traction, now rivaling merchandise in popularity in Europe. This shift reflects a growing desire to create more immersive and memorable experiences for employees.

Spending Patterns Diverge

Interestingly, North America and Europe are charting different courses when it comes to reward spending. In North America, the average annual spend per person on non-cash rewards has dipped to $921, down from $1,090 in 2023. This trend is driven by a focus on moderate-value rewards, with 62% of programs allocating between $100 and $500 per person.

Conversely, Europe is embracing higher-value rewards. The average per-person spend has risen to €924, up from €909 in 2023. Annual spends under €200 have virtually disappeared, signaling a preference for more impactful incentives.

Merchandise: A Tale of Two Continents

This divergence is also evident in merchandise spending. While North America has seen a decline in merchandise expenditures, with the average spend per instance dropping to $177, Europe is experiencing an upward trend, with the average spend per instance rising to €232.

Gift Cards: Denominations Tell a Story

Gift card denominations are also telling a story of two regions. In North America, the average gift card value has decreased to $142, reflecting a shift towards smaller denominations. Europe, however, is moving in the opposite direction, with the average gift card value rising to €182. Gift cards valued at €200 or more now represent 56% of distributions.

Event Gifting Follows the Trend

Event gifting mirrors the broader spending patterns. While North America has seen a nearly 30% decrease in event gifting spend, with the average annual spend per person dropping to $649, Europe is increasing its investment in this area.

Looking Ahead: A Bright Future

Despite these regional differences, the overall outlook for the non-cash rewards industry is positive. As we move further into 2025, expect to see continued growth in experiential rewards, merchandise, and gift cards.

Companies are increasingly recognizing the value of non-cash rewards in driving employee engagement and motivation. By embracing innovation and personalization, they are well-positioned to create impactful reward programs that resonate with their workforce.

Any thoughts, opinions, or news? Please share them with me at vince@meetingsevents.com.

Photo Courtesy of the IRF