The Events Industry Council’s latest quarterly report shows group hotel nights now surpass 2019 bookings

The Events Industry Council (EIC), a global voice of the business events industry, released its quarterly Global Events Barometer for Q2 2024. The numbers reflect positive momentum for the global business events industry in almost every region around the world.

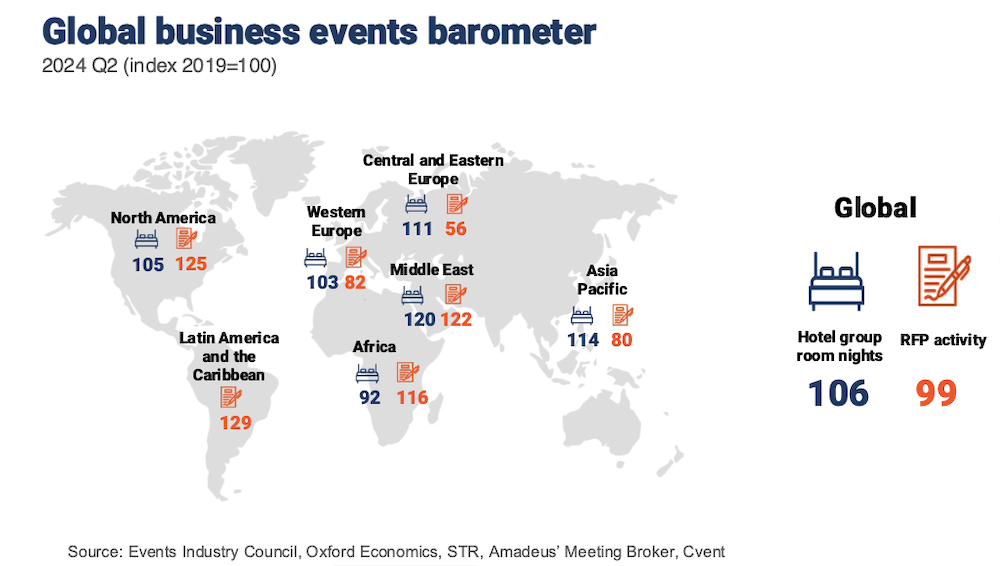

In 2024 Q2, the hotel group room nights index increased to 106. This represents stays during the quarter equivalent to 106% of 2019 levels. The RFP activity index, representing request for proposals (RFPs) sent by event planners during the quarter for future events, increased strongly to 99% of 2019 levels.

Both index components showed gains across almost all global regions, indicating a widespread pick-up in activity. Hotel group demand gains were particularly strong in Middle East and Western Europe. RFP activity gains were strongest in Africa and Latin America and the Caribbean.

As highlighted in EIC’s 2023 Global Economic Significance of Business Events Study released in May 2023, global business events continue to recover from the impacts of the pandemic. A critical piece of that study is understanding the events industry’s recovery as well as where the industry is heading.

EIC’s quarterly Global Events Barometer addresses the need to monitor our progress over time and by key global regions and countries. EIC’s research partner, Oxford Economics, created the Barometer and uses data provided by Amadeus Hospitality, Cvent, the Global Business Travel Association and STR Global to monitor the changes within the market relative to pre-pandemic levels.

The latest global economic outlook anticipates the global recovery will remain steady. Concerns that a U.S. recession could push the world economy on to a weaker growth trajectory are misplaced, the report says. Given the massive overshoot of inflation experienced in recent years, Oxford Economics expects central banks to be cautious and bring policy interest rates down slowly.

Other key findings include:

The Barometer report now also includes data on the recovery in group room rates, representing a key indicator of hotel pricing for business events. Global room rates in RFP responses in 2024 Q2 averaged 124% of 2019 levels.

RFP activity for small events improved to 97% of 2019 levels, showing some of the

improvement that had already been evident in large and medium events.

The top perceived downside risk to businesses in the near term is geopolitical tensions, such as those related to the Middle East, China-Taiwan, and Russia-NATO.

“This report comes at a moment when we as a global society continue to grapple with many challenging issues,” said EIC President and CEO Amy Calvert. “These include the disruptive forces from climate change and related catastrophic weather events, geopolitical turbulence, war taking place on multiple fronts, the threat of continued escalation of tension between rival countries, and the related multiple humanitarian crises.”

Calvert says the industry’s resilience re-enforces its purpose as conduits for human connection and community building. “As a sector we are learning to adapt to the evolving expectations of our constituencies, and the ongoing challenges to support and build our workforce,” she said. “As a federation, we are united in our commitment to fighting complacency and to using the learning of the past few years as a call to action. We must act now as a reflection of our values and our commitment to lead.”

Any thoughts, opinions, or news? Please share them with me at vince@meetingsevents.com.

Photo: Events Industry Council