The latest IRF research reveals a thriving industry through 2026, yet grappling with rising prices

The newly released 2024 Incentive Travel Index (ITI) reports that, overall, growth is projected for the incentive travel industry through 2026. Incentive travel buyers expect activity and per person spending above 2024 levels over the next two years. However, they also report concerns around rising costs, attracting talent to the industry, and safety considerations.

The Incentive Travel Index is a joint initiative of the Incentive Research Foundation (IRF) and the Society for Incentive Travel Excellence (SITE) and is undertaken in partnership with Oxford Economics.

The 2024 online survey, fielded globally from May to July 2024, was

customized for five distinct incentive travel professional roles:

- Corporate end user

- Destination management company (DMC)

- Destination marketing organization (DMO)

- Destination supplier

- Third-party agency (incentive travel agency)

This annual study reports on destination preferences, program inclusions, budgeting, and perceptions of the strategic importance of incentive travel. This year’s report also provides a pulse-check on hot topics such as technology, artificial intelligence, climate issues, and sustainability.

Budgets

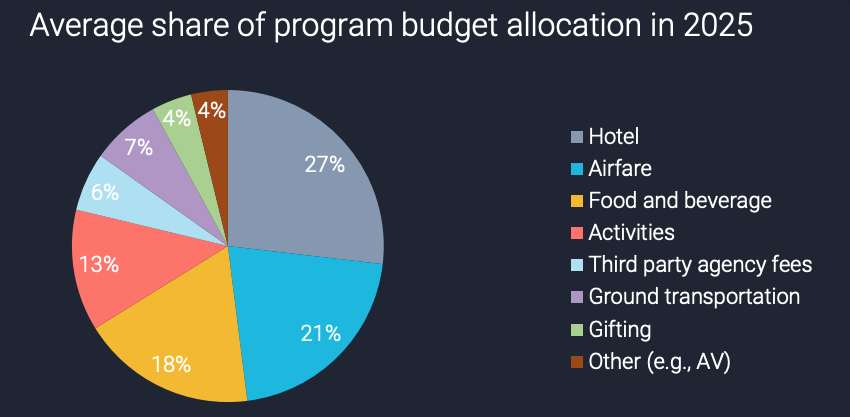

In 2024 the average incentive program cost per person was $4,900. Next year, 37% of incentive buyers predict incentive travel activity to increase, and 54% say spend per person will also rise. By 2026, 45% of buyers expect incentive travel activity to be above or significantly above 2024 levels, with 55% expecting spending increases to match inflation or improve programs. The top areas cited as driving program cost increases were hotels (50%) airfare (47%) and food and beverage (45%).

Goals

The strategic importance of incentive travel is being bolstered by key workplace trends. Retaining talented employees (81%) and competitive advantages in hiring (62%) are cited often as increasing in importance, as well as more recent trends such as new generations of qualifiers and leaders (70%) and a more dispersed workforce (54%).

“The strategic importance of incentive travel is being bolstered by key workplace trends,” said Stephanie Harris, IRF President. “Retaining talented employees and competitive advantages in hiring are cited as increasing in importance, as well as more recent trends such as new generations of qualifiers and leaders and a more dispersed workforce.”

Senior leadership wants incentive travel to do more, meaning that both soft-power and hard-power themes are being emphasized. More than half of senior managers (58%) say incentive travel is playing a more distinct role in motivation and culture building while 40% are managing programs more for financial ROI.

There’s No Place Like Home

Across regions, a significant number of buyers expect to increase incentive travel to destinations that are within closer proximity (40%), while considering destinations not used before. While decreasing distance of travel and increasing resort use (42%), buyers are still looking for new destinations they haven’t used before. “Incentive travel buyers are increasingly looking for something new, with over 70% of our respondents indicating they are seeking destinations they haven’t used before,” said SITE CEO, Annette Gregg. “Resorts – both all-inclusive and regular – have gained in popularity, while destinations within shorter distances from participant origin are also expected to see increased use.”

Any thoughts, opinions, or news? Please share them with me at vince@meetingsevents.com.

Photo: IRF